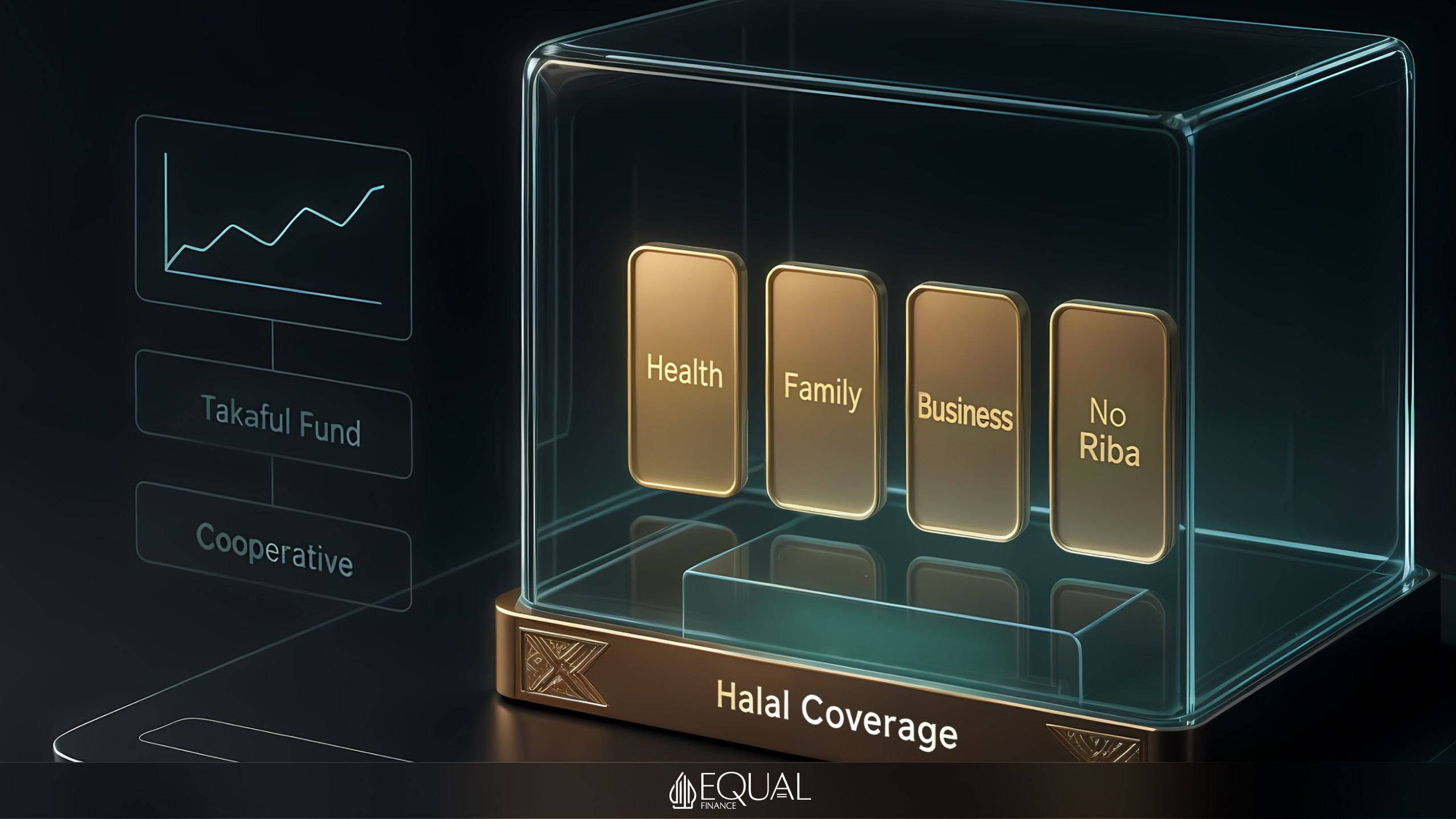

What is Islamic Insurance? Islamic insurance, or takaful, is a financial system deeply rooted in Sharia principles derived from the Quran and Hadith. Unlike conventional insurance, which prioritizes profit through premiums and investments, takaful focuses on mutual assistance and collective responsibility. Participants contribute to a shared fund, which is then used to compensate any member […]

Метка: sharia

Musharakah: Fair Profit Sharing in Islamic Finance

Musharakah is a cornerstone of Islamic finance. It establishes a joint partnership in which multiple parties commit capital or other resources to undertake a venture. Each partner shares in profits and bears losses according to their proportional contributions. This structure eliminates interest (riba), emphasizing genuine collaboration. It also aligns with ethical principles that reinforce mutual […]

Murabaha: Sharia-Compliant Trade Financing

Murabaha is among the most widely used instruments in Islamic finance, representing a trade-based contract that replaces conventional lending with a markup sale. Instead of charging interest, the financial institution or investor first purchases an asset and then resells it to the client at a higher price, clearly disclosing the cost and agreed markup. This […]

Mudaraba: An Islamic Method of Raising Capital

Mudaraba is a foundational contract in Islamic finance that facilitates the pooling of resources between two parties. One party provides capital (the rabb-ul-mal), while the other offers expertise and managerial efforts (the mudarib). Profits are shared according to a predetermined ratio, and no fixed interest is charged. This arrangement is rooted in Sharia principles, emphasizing […]

What Are Islamic Finances and Why Are They Gaining Popularity?

Islamic finance represents an alternative financial system guided by the principles of Sharia law. It prohibits certain conventional banking practices and requires transparency, ethical standards, and social responsibility. Many people are drawn to this model because it emphasizes fairness, risk-sharing, and a commitment to real economic activities. Unlike some traditional structures, it avoids profiting from […]

Introduction to the Islamic Dow Jones Index

The Islamic Dow Jones Index emerged in response to a rising demand for Sharia-compliant investment opportunities. It filters companies based on Islamic principles, excluding sectors like alcohol, gambling, and interest-based finance. This index has become a global benchmark for ethical investors seeking to merge financial growth with religious guidelines. Since its inception, it has been […]

Halal Stock Market: A Path to Ethical Investment

Halal stock market investing offers a unique way to align financial goals with moral principles. It is an approach built upon Islamic guidelines, which prioritize social responsibility and prohibit exploitative practices. Investors who follow these teachings aim to avoid industries linked to gambling, alcohol, and interest-based financing. By selecting stocks that comply with Sharia principles, […]

Islamic Banking in the Global Financial System

Over the past few decades, Islamic banking has become one of the fastest-growing segments of the global financial industry. Whereas in the mid-20th century, Sharia-based principles were mostly confined to local Muslim regions, today Islamic banking in the global financial system is steadily carving out a niche, attracting leading market players and investors. This article […]

Islamic Finance for Individuals

When we talk about Islamic finance, large-scale projects, investments, government financing, and sukuk often come to mind. However, a key part of the Sharia-based economy also involves the daily financial life of ordinary people. Islamic finance for individuals addresses how Muslims (and not only) can apply Sharia principles to personal money management, banking operations, and […]