What is Islamic Insurance?

Islamic insurance, or takaful, is a financial system deeply rooted in Sharia principles derived from the Quran and Hadith. Unlike conventional insurance, which prioritizes profit through premiums and investments, takaful focuses on mutual assistance and collective responsibility. Participants contribute to a shared fund, which is then used to compensate any member facing losses.

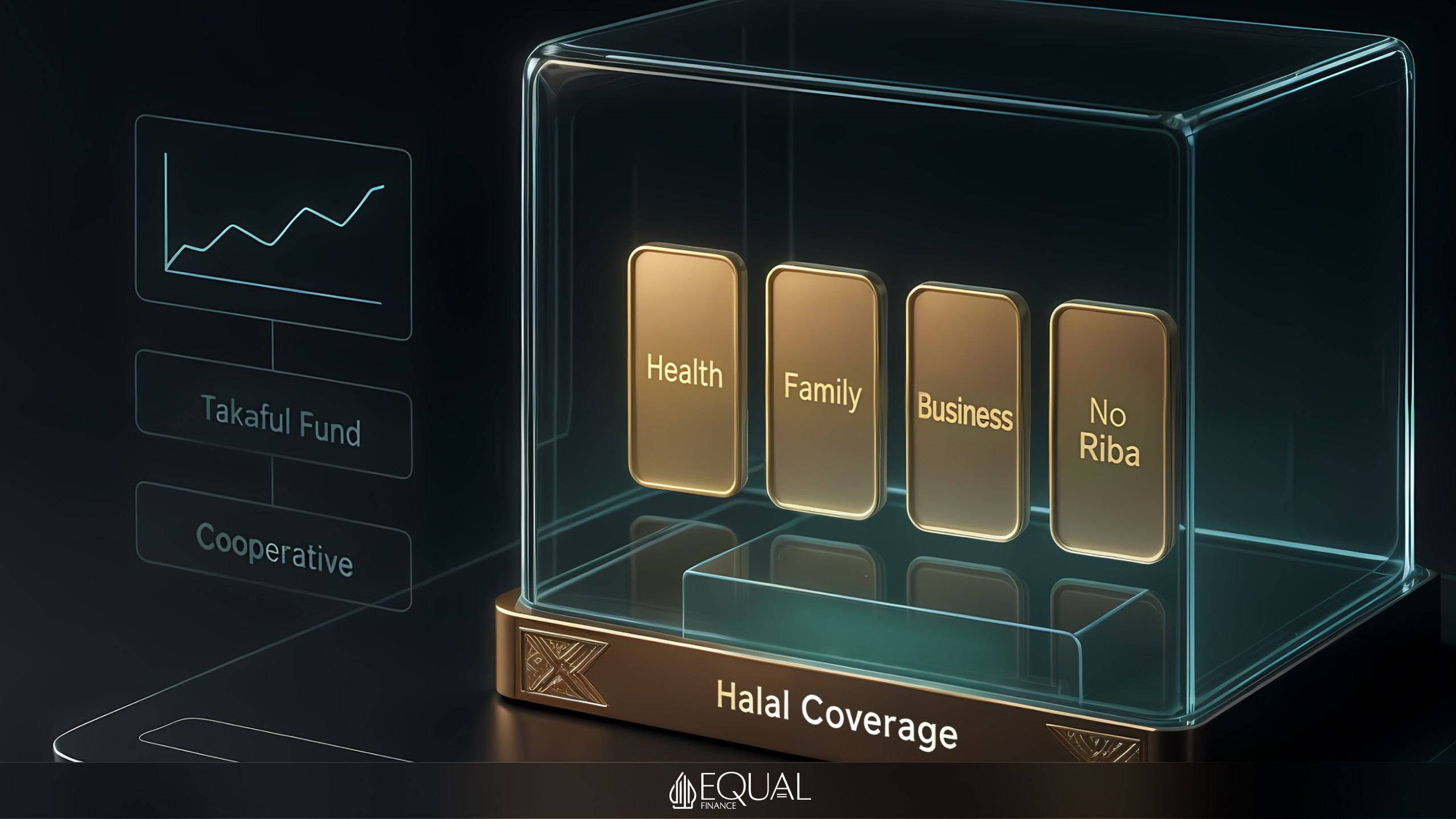

The system prohibits interest (riba), gambling (maisir), and excessive uncertainty (gharar), ensuring compliance with Islamic law. Investments are restricted from haram industries like alcohol, tobacco, gambling, or arms, emphasizing ethical and halal practices. Takaful is more than insurance—it’s a cooperative framework promoting solidarity and fairness among its members.

Historically, its roots trace back to early Islamic communities, where mutual support was a norm during hardships. The modern version emerged in the 20th century, blending tradition with contemporary financial needs. Today, it’s a vital segment of Islamic finance, offering a distinct alternative to conventional insurance products.

How Takaful Works

Takaful revolves around the concept of «ta’awun,» meaning mutual help, setting it apart from the profit-driven nature of traditional insurance. Participants pool their contributions into a fund managed by an operator under strict Sharia guidelines. These funds are invested in permissible assets, such as real estate, infrastructure, or ethical businesses, avoiding speculative ventures.

When a member experiences a loss—be it illness, property damage, or death—payouts are drawn from this collective pool. Investment profits are shared among participants based on their contributions, while the operator earns a pre-agreed fee or profit share for its services. Surpluses, if any, are either redistributed to members as bonuses or reinvested into the fund, rather than retained by the insurer as in conventional systems.

A Sharia supervisory board oversees the fund, ensuring all operations align with Islamic principles. This oversight builds trust and transparency, critical for its target audience. The voluntary nature of participation further reinforces the community spirit inherent in takaful.

Differences from Conventional Insurance

Conventional insurance often clashes with Islamic values due to its reliance on interest and speculative financial tools like derivatives. In this model, the insurer assumes all risks, while clients pay premiums without ownership over the funds. Profit comes from the gap between collected premiums and paid claims, sometimes leading to misaligned incentives.

Takaful, however, distributes risks across all participants, with the operator acting as a manager rather than a risk-bearer. Members co-own the fund, fostering a sense of partnership rather than a transactional relationship. Its focus on ethical goals over profit distinguishes it as a socially responsible option.

Investment strategies also differ: conventional insurers can invest anywhere, including haram sectors, while takaful sticks to halal opportunities. This clarity and moral grounding appeal to Muslims and ethically conscious individuals alike. As a result, takaful stands out as a fairer, more transparent alternative in the insurance landscape.

Types and Practical Examples

Takaful serves a broad range of needs, from personal to commercial, making it a versatile financial tool. Family takaful is popular for safeguarding loved ones, enabling savings for education, weddings, or support in case of a breadwinner’s death. General takaful protects assets like homes, cars, or businesses against risks such as fire, theft, or natural disasters.

In nations with robust Islamic finance ecosystems, like Malaysia, the UAE, and Saudi Arabia, takaful holds a significant market share. Companies like Syarikat Takaful Malaysia Berhad compete with global players like Allianz, offering Sharia-compliant alternatives. In Indonesia, family takaful supports millions in planning their financial futures, blending insurance with investment benefits.

Beyond Muslim-majority regions, takaful gains traction in places like the UK, where firms like Salaam Insurance cater to property and auto needs. Its ethical appeal drives adoption among diverse audiences. These examples highlight takaful’s adaptability to modern challenges while staying true to its principles.

Why Takaful is Gaining Traction

Several factors fuel takaful’s rising popularity in today’s world. The growing Muslim population—over 1.8 billion people—creates demand for Sharia-compliant financial solutions, especially in regions where conventional insurance is scarce or incompatible with faith. Additionally, its ethical framework attracts non-Muslims who value transparency and socially responsible investments, aligning with global trends.

Takaful’s resilience during economic crises, like the 2008 downturn, underscores its stability, thanks to its cooperative structure and avoidance of speculative markets. Major financial hubs, such as London and Dubai, are embracing it, offering products to international clients. Support from institutions like the World Bank and the Islamic Development Bank bolsters its growth through research and funding initiatives.

The Islamic finance sector, including takaful, reached $4.5 trillion in 2022, with forecasts of $6.7 trillion by 2027, per LSEG data. Innovations like digital takaful platforms and eco-friendly «green» products further boost its appeal. Together, these elements position takaful as a global financial force, not just a niche religious offering.