What is Social Responsibility in Islamic Finance? Social responsibility is a core pillar of Islamic finance, rooted in Sharia’s ethical framework from the Quran and hadiths. Islamic finance demands fairness, transparency, and a ban on exploitation, inherently tied to societal welfare. Unlike conventional finance, where profit often reigns supreme, Islamic finance prioritizes community well-being alongside […]

Рубрика: Sharia Law and Financial Instruments

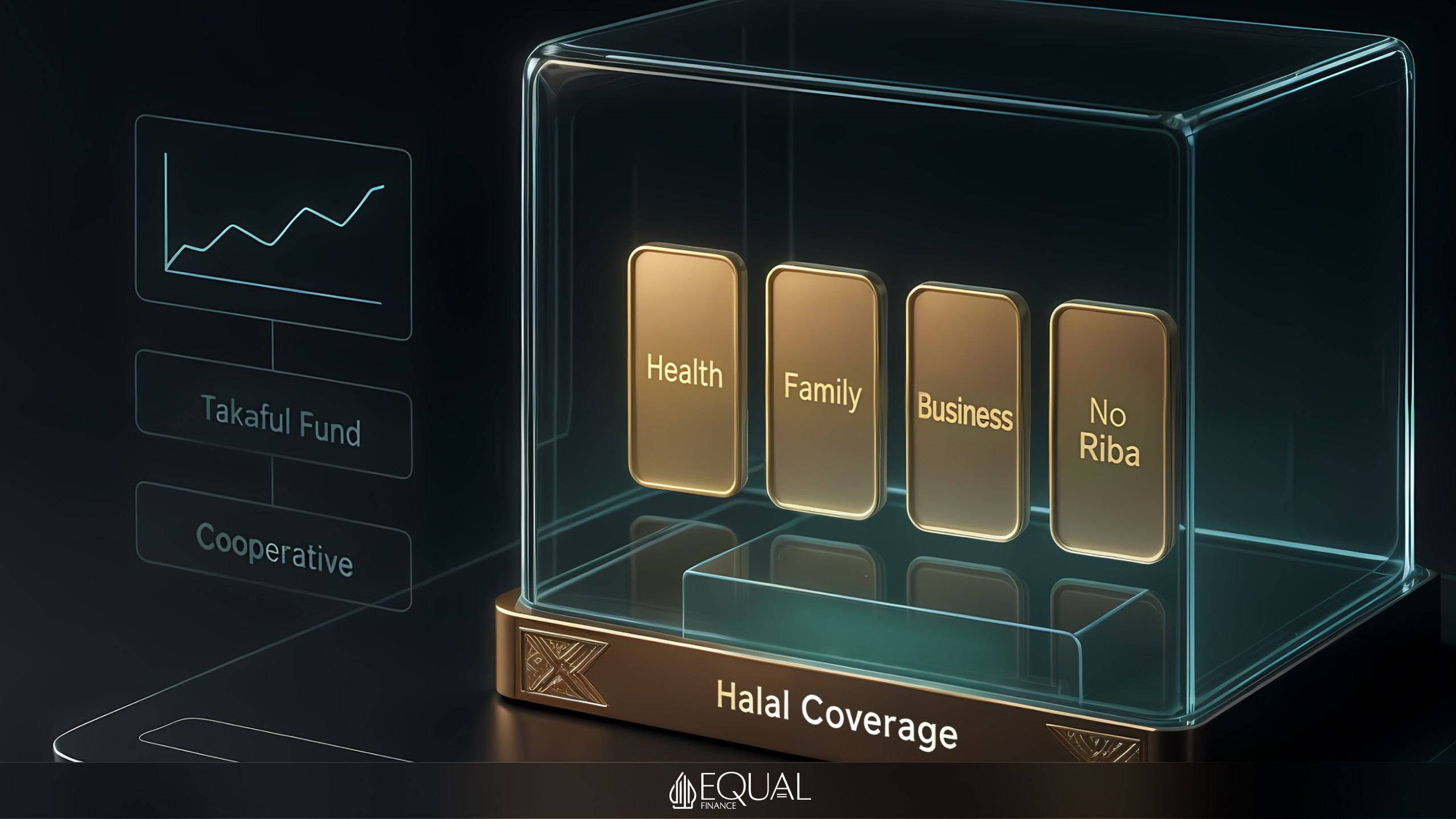

Navigate the intricacies of Sharia-compliant investing with this comprehensive category. Understand what constitutes halal (permissible) and haram (forbidden) in the context of investments. Gain knowledge about concepts like riba (usury) and how to avoid it, and explore halal alternatives for insurance and investment that align with Islamic principles.

Sukuk: What Are Islamic Bonds and How to Invest in Them?

What Are Sukuk? Sukuk are Islamic financial instruments, a form of Sharia-compliant securities akin to bonds, rooted in the Quran and the Prophet Muhammad’s teachings. Unlike conventional debt tools, they grant ownership in tangible assets—real estate, infrastructure, or equipment—rather than promising interest-based returns. This structure avoids riba (interest), aligning with Islamic prohibitions, and ties income […]

How is Islamic Insurance (Takaful) Structured?

What is Islamic Insurance? Islamic insurance, or takaful, is a financial system deeply rooted in Sharia principles derived from the Quran and Hadith. Unlike conventional insurance, which prioritizes profit through premiums and investments, takaful focuses on mutual assistance and collective responsibility. Participants contribute to a shared fund, which is then used to compensate any member […]

Musharakah: Fair Profit Sharing in Islamic Finance

Musharakah is a cornerstone of Islamic finance. It establishes a joint partnership in which multiple parties commit capital or other resources to undertake a venture. Each partner shares in profits and bears losses according to their proportional contributions. This structure eliminates interest (riba), emphasizing genuine collaboration. It also aligns with ethical principles that reinforce mutual […]

Murabaha: Sharia-Compliant Trade Financing

Murabaha is among the most widely used instruments in Islamic finance, representing a trade-based contract that replaces conventional lending with a markup sale. Instead of charging interest, the financial institution or investor first purchases an asset and then resells it to the client at a higher price, clearly disclosing the cost and agreed markup. This […]

Haram and Halal in Finance: How to Invest Ethically

In Islam, the terms “halal” (permitted) and “haram” (forbidden) establish the boundaries of acceptable behavior under Sharia law. While many people are familiar with these concepts in relation to dietary rules, their impact extends far into the financial world. Ethical investing, free from forbidden sectors or practices, is a cornerstone of Islamic economics. Yet determining […]

What Is the Prohibition of Interest (Riba) in Islamic Finance?

The concept of charging or paying interest has long been central to most conventional financial systems. However, in Islamic finance, the practice known as riba—broadly interpreted as usury or unjust increases on loans—is firmly forbidden by Sharia law. The term “riba” stems from Arabic, meaning “increase” or “excess,” emphasizing the idea of illegitimate gain from […]

Mudaraba: An Islamic Method of Raising Capital

Mudaraba is a foundational contract in Islamic finance that facilitates the pooling of resources between two parties. One party provides capital (the rabb-ul-mal), while the other offers expertise and managerial efforts (the mudarib). Profits are shared according to a predetermined ratio, and no fixed interest is charged. This arrangement is rooted in Sharia principles, emphasizing […]

New Milestones for Islamic Finance

Russia’s latest legislative measures have laid the groundwork for experimental zones in specific regions. According to Interfax, these trials will last two years, granting banks permission to introduce products aligned with Shariah principles. This legal framework is a significant milestone, showing that government bodies see potential in diversifying financial instruments. By prohibiting riba (usury), Islamic […]

Introduction to the Islamic Dow Jones Index

The Islamic Dow Jones Index emerged in response to a rising demand for Sharia-compliant investment opportunities. It filters companies based on Islamic principles, excluding sectors like alcohol, gambling, and interest-based finance. This index has become a global benchmark for ethical investors seeking to merge financial growth with religious guidelines. Since its inception, it has been […]