When over 15,000 participants, 4,000+ companies, and crypto leaders from more than 160 countries gathered at Madinat Jumeirah in Dubai for TOKEN2049 Dubai 2025, the message was clear: this wasn’t just another tech expo — it was the birthplace of next-gen financial paradigms. At the core of this year’s event stood a powerful and timely […]

Blog

TOKEN2049 Dubai 2025: Leading Crypto and Islamic Finance

TOKEN2049 Dubai 2025, held on April 30–May 1 at Madinat Jumeirah, gathered 15,000 attendees from 4,000+ companies across 160+ countries. The event featured 200+ speakers, including Binance CEO Richard Teng and Circle CEO Jeremy Allaire, discussing blockchain’s future. TOKEN2049 Week (April 28–May 4) hosted 500+ side events, from hackathons to yacht parties, making Dubai a […]

TOKEN2049 Dubai 2025: A Hub for Crypto and Islamic Finance

TOKEN2049 Dubai 2025, held on April 30–May 1 at Madinat Jumeirah, attracted 15,000 attendees from 4,000+ companies across 160+ countries. The event featured 200+ speakers, including Binance CEO Richard Teng, exploring blockchain’s future. TOKEN2049 Week (April 28–May 4) included 500+ side events, from hackathons to yacht parties, making Dubai a Web3 epicenter. Attendees enjoyed NFT […]

Halal Investment Options: Opportunities for Ethical Capital Allocation

Halal investments, compliant with Sharia principles, are gaining traction not only among Muslims but also among investors seeking ethical and sustainable financial instruments. In 2025, the global Islamic asset market is valued at $5 trillion, growing at 15–25% annually. This article explores key halal investment options, their features, and prospects, based on the latest data. […]

Islamic Finance in Russia: Development, Challenges, and Prospects

Islamic finance, grounded in Sharia principles, is gaining momentum worldwide, and Russia is actively joining this trend. Since 2023, the country has been conducting an experiment to introduce partner financing compliant with Islamic law. This article explores the current state of Islamic finance in Russia, key achievements, challenges, and prospects for 2025, drawing on the […]

Islamic Finance and Social Responsibility: A Comprehensive Perspective

Islamic finance is not merely a system of interest-free transactions governed by Sharia law—it is a deeply ethical economic model that prioritizes justice, sustainability, and social welfare. Unlike conventional systems that often measure success solely by profit margins, Islamic finance integrates moral accountability into every financial activity, ensuring that all transactions promote the public good […]

Sukuk: The Prospects of Islamic securities in Global Financial Markets

Islamic finance has moved beyond being a niche alternative—it is becoming a key component of the global financial architecture. At the heart of this system lies sukuk, or Islamic securities, a kind of bond analogue, which are structured to comply with the principles of Sharia. Unlike conventional bonds that are based on interest (riba), sukuk […]

Takaful: Advantages and Differences from Conventional Insurance

What is Takaful? Takaful is an Islamic insurance system compliant with Sharia principles. The term comes from the Arabic word “takafala,” meaning mutual responsibility. Participants contribute to a shared fund. This fund covers claims during insured events. The system avoids interest, gambling, and uncertainty, prohibited in Islam. Takaful is built on mutual help and cooperation. […]

Riba and Haram: Key Restrictions in Islamic Finance

Islamic finance is built on Shariah principles, ensuring fairness and ethics. Two central restrictions are riba (interest) and haram (prohibited activities). These concepts set Islamic finance apart from conventional systems. Understanding riba and haram helps investors and clients comply with religious norms. This article explains these restrictions in detail. You’ll learn how they shape financial […]

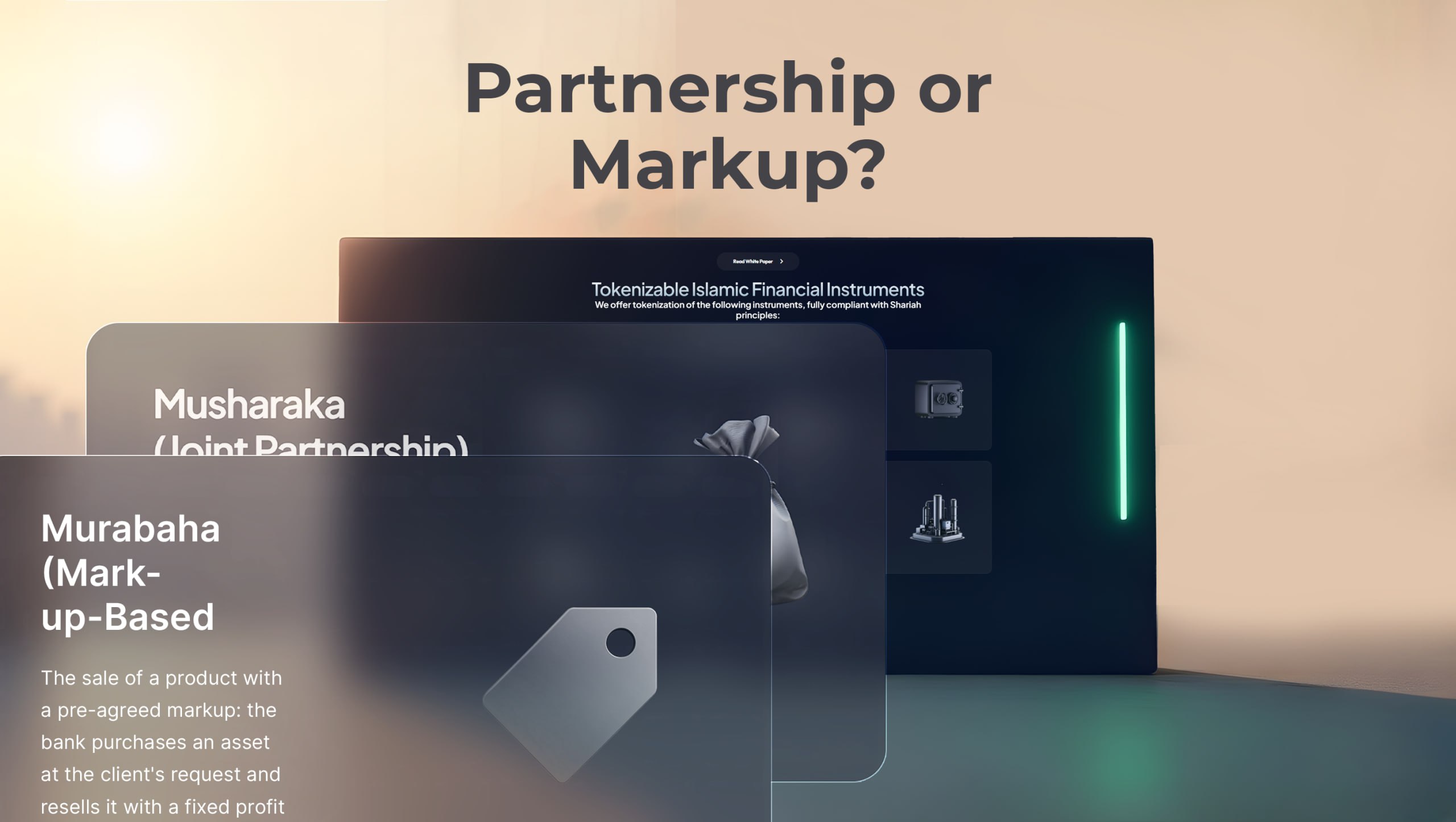

Murabaha vs Musharaka: What Should an Investor Choose?

Islamic finance is growing due to its ethical and Shariah-compliant nature. Murabaha and musharaka are two key tools attracting investors. They differ in structure, risks, and potential returns. This article explores both methods in detail. You’ll learn their features, benefits, and drawbacks. This will help you make an informed decision. Investors can select the tool […]